Matrix Files

Where You Have Taken The Red Pill

Coin's Financial Course - Chapter VI - THE SIXTH DAY.

« Chapter V PDF File found here Appendix »

CHAPTER VI.

The manner in which the little lecturer had handled his subject on the fifth day had greatly enhanced his popularity. What he had said, had been in the nature of a revelation to nearly all that heard it, and his grouping of facts had made a profound impression.

What created the most comment, was his statement as to the space in which all the gold and silver of the world could be placed. In all the hotel lobbies it was the subject of conversation. The bare statement that all the gold in the world could be put in a cube of 22 feet appeared ridiculous - absurd.

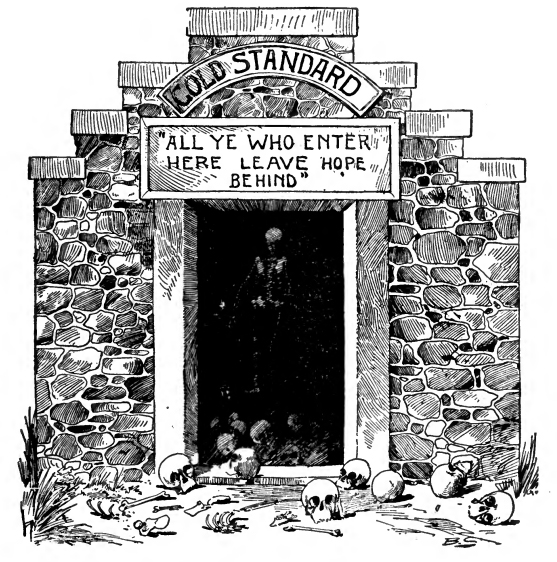

Few that had entertained the single gold standard view of the monetary question were willing to believe it. They argued that it was impossible; that the business of the world could not be transacted on such an insignificant amount of property for primary money. They said, "Wait till the morning papers come out; the Tribune would puncture it, the Inter Ocean, Herald, in fact, all of the papers would either admit it by their silence, contradict it or give the facts."

At the Grand Pacific Hotel the cashier was kept busy answering requests to see a twenty-dollar gold piece. They wanted to measure it to get its diameter and thickness. As none was to be had, they had to content themselves with measuring up silver dollars and figuring out how much space all the silver in the world would occupy. This resulted in confirming COIN'S statement.

Mr. George Sengel, a prominent citizen of Fort Smith, Arkansas, while discussing the subject with a large party in the rotunda of the Palmer House, stood up in a chair and addressed the crowd, saying:

Gentlemen, I have just been up in COIN'S room and examined the government reports as to the amount of gold and silver in the world, and have made the calculation myself as to the quantity of it, and I find that the statements made are true. All the gold and silver in the world obtainable for money can be put in the office of this hotel, and all the gold can be put in this office and not materially interfere with the comfort of the guests of the house.

"I have been until today in favor of a single gold standard, but hard times, and this fact that all the gold in the world available for money can be put in a space of twenty-two feet each way, has knocked it out of me. Count on me and old Arkansas for bimetallism."

Mr. Sengel's speech was greeted with applause, and he was followed by others expressing similar views. The morning papers gave full reports of the previous day's lecture. All editorially confirmed COIN'S statement as to the quantity of gold and silver in the world, and the space it would occupy, except the Herald and Tribune; they were silent on the subject.

It was generally known that COIN would discuss independent action of the United States on the last day, and from the number that tried to gain admission, a hall many times as large could have been easily filled.

At the hour for opening the hall large crowds surrounded the entrance to the Art Institute, and the corridors were filled with people. In the large hall where the lectures were delivered the walls had been decorated with the American colors. This had been seen to by a committee of bimetallists ; they had given special attention to the decorations around the platform, and though assuming many forms, each piece had been made from United States' flags. The scene presented was striking and patriotic.

When the doors were opened the hall was soon filled and thousands were turned away. COIN was escorted by a committee of bimetallists in carriages from his hotel to the Art Institute, each carriage used by the committee being draped in the American colors. It was the first demonstration of the kind made in honor of the little financier of the people, since the lectures had begun.

The evidences of his popularity were now to be seen on every hand. Many, however, had reserved their judgement to hear from him on the United States taking independent action, and all were anxious to listen to what he would say on that subject.

His appearance upon the platform was the signal for an ovation. He had grown immensely popular in those last five days.

He laid his silk hat on the table, and at once stepped to the middle of the platform. He raised his eyes to the audience; slowly turned his head to the right and left, and looked into the sea of faces that confronted him.

INDEPENDENT FREE COINAGE.

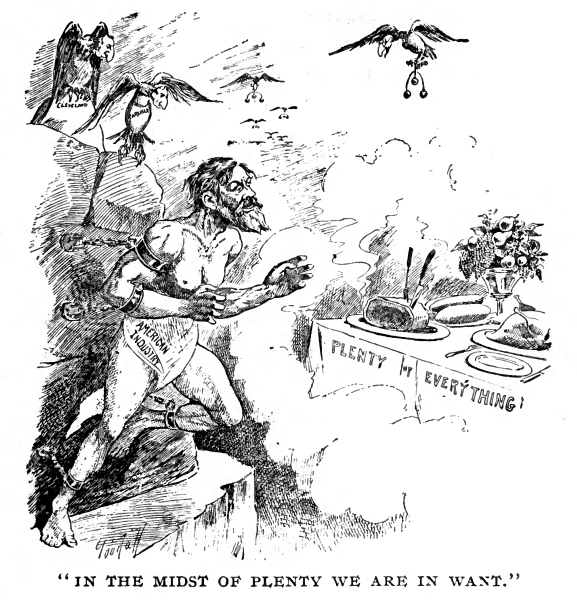

"In the midst of plenty, we are in want," he began. "Helpless children and the best womanhood and manhood of America appeal to us for release from a bondage that is destructive of life and liberty. All the nations of the Western Hemisphere turn to their great sister republic for assistance in the emancipation of the people of at least one-half the world.

"The Orient,with its teeming millions of people, and France, the cradle of science and liberty in Europe, look to the United States to lead in the struggle to roll back the accumulated disasters of the last twenty-one years. What shall our answer be?" [Applause.]

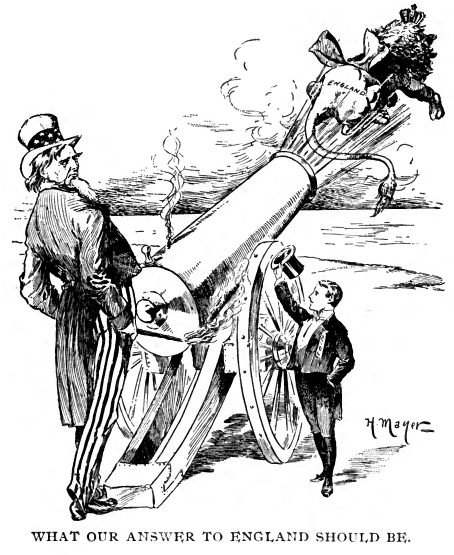

"If it is claimed we must adopt for our money the metal England selects, and can have no independent choice in the matter, let us make the test and find out if it is true.

"A war with England would be the most popular ever waged on the face of the earth. [Applause.] If it is true that she can dictate the money of the world, and thereby create world-wide misery, it would be the most just war ever waged by man. [Applause.]

"But fortunately this is not necessary. Those who would have you think that we must wait for England, either have not studied this subject, or have the same interest in continuing the present conditions as England. It is a vain hope to expect her voluntarily to consent. England is the creditor nation of the globe, and collects hundreds of millions of dollars in interest annually in gold from the rest of the world. We are paying her two hundred millions yearly in interest. She demands it in gold ; the contracts call for it in gold. Do you expect her to voluntarily release any part of it? It has a purchasing power twice what a bimetallic currency would have. She knows it.

"The men that control the legislation of England are citizens of that country with fixed incomes. They are interest gatherers to the amount annually of over one thousand millions of dollars. The men over there holding bimetallic conventions, and passing resolutions, have not one-fifth the influence with the law-making power that the bimetallists in the United States have with our Congress and President. No; nothing is to be expected from England.

"Whenever property interests and humanity have come in conflict, England has ever been the enemy of human liberty. All reforms with those so unfortunate as to be in her power have been won with the sword. She yields only to force. [Applause.]

"The money lenders in the United States, who own substantially all of our money, have a selfish interest in maintaining the gold standard. They, too, will not yield. They believe that if the gold standard can survive for a few years longer, the people will get used to it - get used to their poverty - and quietly submit.

"To that end they organize international bimetallic committees and say, 'Wait on England, she will be forced to give us bimetallism.' Vain hope! Deception on this subject has been practiced long enough upon a patient and outraged people.

"With silver remonetized, and gold at a premium, not one-tenth the hardships could result that now afflict us. Why? First: it would double the value of all property. Second: only 4 per cent of the business of the people of this nation is carried on with foreign countries; and a part of this 4 per cent would be transactions with silver using nations; while 96 per cent of the business of our people is domestic transactions. Home business. Is it not better to legislate in the interest of 96 per cent of our business, than the remaining 4 per cent?

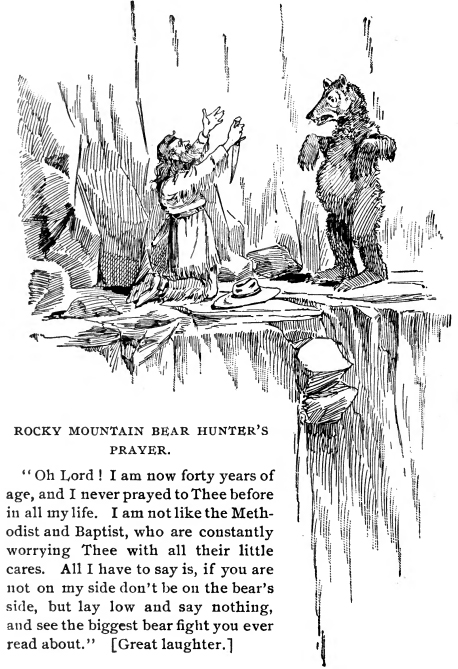

"We now face the situation and must act. We are similarly situated to the Rocky Mountain bear hunter, when meeting a bear in a level trail on a mountain side, with a cliff on the one hand and a perpendicular precipice on the other. This Rocky Mountain bear hunter could neither dodge to the right or left, and there was no friendly tree near, his only weapon his knife, and no alternative but to fight.

"It was to be the bear fight of his life. He knelt down and made this prayer, while the bear looked on with curiosity:

"In the impending struggle for the mastery of the commerce of the world, the financial combat between England and the United States cannot be avoided if we are to retain our self-respect, and our people their freedom and prosperity. [Applause.]

"The gold standard will give England the commerce and wealth of the world. The bimetallic standard will make the United States the most prosperous nation on the globe. [Applause.]

"To avoid the struggle means a surrender to England. It means more - it means a tomb raised to the memory of the republic. Delay is dangerous. At any moment an internecine war may break out among us. Wrongs and outrages will not be continuously endured. The people will strike at the laws that inflict them.

"To wait on England is purile and unnecessary. Her interests are not our interests. 'But,' you ask me, 'how are we to do it?' It will work itself. We have been frightened at a shadow. We have been as much deceived in this respect as we have about other matters connected with this subject.

"Free coinage by the United States will at once establish a parity between the two metals. Any nation that is big enough to take all the silver in the world, and give back merchandise and products in payment for it, will at once establish the parity between it and gold. [Applause.]

"France and the Latin Union, with less population and wealth than we have, maintained a premium on silver for forty years by opening their mints to its free coinage, and at a ratio of 15½ to 1, while ours was 16 to 1.

"If France could lift the commercial value of silver above that fixed by the other nations of the world, and at a premium over gold, the United States can hold its commercial value at a par with gold.

"But we alone would not have to maintain it. We know now that Mexico, South and Central America, the Asiatic governments and France would be with us from the start. The nations that would immediately support bimetallism are stronger in 1894, than those were in 1873 that maintained it then. Of all those that we had then, we would start with only the loss of Germany and Austria, and a few lesser principalities." [Applause.]

Mr. Lyman Gage, president of the First National Bank, who put questions to COIN on the second day of the school, now interrupted the speaker.

"Suppose," said Mr. Gage, "that after all, the independent action of the United States did not establish the parity between the two metals?"

"Why hesitate at the supposition of an improbability," replied COIN. Continuing he said:

"To suppose that such will be the case is to borrow trouble that is not at all likely to occur. But if it does, we are more fruitful of resources than are the obstacles insurmountable that may be thrown in our way.

"To begin with, we would want an administration at Washington that is friendly to republican institutions.

"The government should exercise its prerogative as of old to pay in either metal it sees fit. Gold must be given to understand that it is not indispensable to the currency of the country. This will depreciate its importance. The bankers of the great money "CENTER"s must be given to understand that they must take their hands off the throat of the government. That they cannot dictate to the government what is money. The government will dictate that to them. The selfishness of the few must submit to the interests of the many. We will then be better able to dictate to other governments what the United States wants as she leads in the column of bimetallic nations.

"The unlimited demand for silver, and its free use by the government, will appreciate its value. To that extent the disuse of gold will depreciate its value. If necessary, fire a man bodily into the street to teach him his place. Gold needs that lesson.

"With both metals as primary money, property advances to bimetallic values, whether gold goes to a premium or not. Gold may go out of circulation, but its doing so does not disturb the practical effect of bimetallic prices.

"There should be a law making it a forfeiture of the debt to discriminate in favor of one form of national currency as against another. Our national currency should be as sacred as our national flag. The present law allowing gold to be named in the bond is statutory treason. The government would stand ready to redeem its paper and token money in primary money on demand, and should not allow any discrimination that would forestall its action or corrupt its financial system.

"With an administration in sympathy with bimetallism there would be no trouble as to the parity of the two metals. It could throw its great influence in favor of the weaker of the two metals if necessary in sustaining that parity.

"But," said Mr. Gage, "if after a fair trial gold continued at a premium, what remedy would you suggest?"

"Put less gold in the gold dollar," replied COIN.

"Bring the weight of the gold dollar down till they are on a parity." [Applause.]

Mr. Gage took his seat, but when COIN was about to resume he again interrupted the little speaker.

"Suppose," said Mr. Gage, "the free coinage of silver by the United States should flood us with silver? What would we do with it?"

"Put it in the pockets of the people" replied COIN. "Put it to work; put it in the channels of trade. If we desired to store it, we could put it all in your bank." [Applause.]

"But it would drive out our gold?" asserted Mr. Gage. "Our gold is leaving us now," replied COIN.

"Could it leave us any faster? It is now going at the rate of from $500,000 to $2,000,000 a day. Is a drought of gold to be more desired than a flood of silver? It is only a question of time under a gold system when England will take it all. The way to keep our gold is to remonetize silver. Remonetization will give us higher prices for our exports, and will make a balance of trade in our favor large enough to bring us English gold and silver.

"Now, Mr. Gage," said COIN, "may I ask you a question?"

"Certainly," replied Mr. Gage.

"Is it not a fact," said COIN, "that no estimate has been placed on American (United States) bonds held in Europe at less than 5,000 million dollars?"

"Yes, I believe that is true," answered Mr. Gage.

"And is not the largest part of this sum owned in England?" continued COIN.

"I suppose it is," answered Mr. Gage.

"And has not," said COIN "the large shipments of gold to England recently given rise to the opinion in commercial circles that our bonds are held there to a larger amount than 5,000 million dollars.

"Yes," said Mr. Gage.

"Does not these securities," COIN went on, "consist largely of railroad, municipal and other bonds drawing from 4 to 6 per cent interest?"

"I suppose so," assented the banker. "Then would you not," said COIN, "consider 4 per cent as a fair average interest on our bonds held in England?"

"Yes, I should think so," replied Mr. Gage.

"Mr. Gage" said COIN, "4 per cent on 5,000 million dollars is 200 million dollars. It has all been made payable in gold. The total production of gold in the world annually is about 165 millions, and of this the United States produces annually about 35 millions. Now unless the balance of trade is increased largely, how may we expect to pay this 200 millions in gold annually?

"The selling of more bonds in England will get us gold with which to pay it," replied the eminent financier.

"But does not that increase the annual interest to be paid?" asked COIN.

"Yes," said Mr. Gage, reluctantly.

"And where will it end?" continued COIN.

"I don't know," hesitatingly replied Mr. Gage, and with bewilderment in his face he resumed his seat. COIN now addressed himself to the audience, that showed evident signs of pleasure and satisfaction with the dialogue that had just taken place.

"We have put our heads in the mouth of the English lion, and the question now is how to get it out. I don't like Mr. Gage's plan.

[Applause.]

"His plan consists in putting our heads farther in.

[Applause.]

"It is the same plan the bankers have adopted for the government to get gold. [Applause.] It will all end, if the present policy is continued, in England owning us body and soul. She is making a peaceable conquest of the United States. What she failed to do with shot and shell in the eighteenth century, she is doing with the gold standard in the nineteenth century. [Applause.] The conservative monied interest furnished the tory friends of England then, and it furnishes her friends now. [Applause.] The business men of New York City passed strong resolutions against the Declaration of Independence in 1776, and they are passing strong resolutions against an American policy now."

[Applause.]

"The objection to independent bimetallism is that the parity between the two metals cannot be maintained at our ratio of 16 to 1. That is the gold (23.2 grains) in the gold dollar will be worth more than the silver (371¼ grains) in the silver dollar. We have twice changed the quantity of gold in the gold dollar; each time making it less. If the commercial value of 23.2 grains of gold is more than the commercial value of 371¼ grains of silver, then reduce it to 22, 21, 20 grains or less if necessary to put the two at a ratio, where the practical effect of free coinage, when once set to working again, will demonstrate that the ratio is at its natural point, and parity easily obtained. Reducing the gold in the gold dollar would leave gold for more dollars, and this would assist in establishing rising prices as it would multiply the number of dollars. The weight of the silver dollar should not be changed. Its integrity should be preserved as originally fixed.

"There can be no objection to this plan, for as we have seen the parity of the two metals was maintained for hundreds of years. The bimetallists do not believe that the ratio has much influence. They believe that the influence of unlimited free coinage is so great in establishing the commercial parity of the two metals, that any ratio near the natural ratio of 1 to 15⅔ will give satisfaction.

"In this controversy, one point should never be lost sight of, and that is, that higher prices - bimetallic prices - will come with remonetization of silver, even though gold goes to a premium.

"It is a fixed law in the science of money that when both metals are primary money - whether at the time seeking the mints or not, and whether in circulation or not - bimetallic prices prevail.

Mr. P. A. H. Franklin, a prominent bimetallist of Chicago, wanted to know of COIN, in case it was necessary or desirable, if there were any practical method to force England to adopt bimetallism?

COIN'S reply was: "Yes. It is not probable that such an emergency can arise; but if it does all we would have to do would be to put an excessive tariff on all imports coming from her, and all other countries having a gold standard, until they adopted a bimetallic system with the same ratio as ours.

"England could not afford to stay out of our market-; while France was enjoying them. The English people would raise a clamour that would soon lead to bimetallism. If such a course on our part conflicts with treaties treaties should be broken. When humanity, or the life of a nation, is involved, all treaties are at an end.

"If England wages a war on humanity, the United States should declare an industrial war on England.

[Applause.]

"England demonetized silver in 1816, and yet from that period to 1873 the parity of the two metals was not affected; we did not need her then, and we do not need her now.

"When the nations giving importance to silver, are as numerous and as strong as those giving importance to gold, a parity is naturally produced.

"The farmer in Mexico sells his bushel of wheat for one dollar. The farmer in United States sells his bushel of wheat for 50 cents. The former is proven by the history of the world to be an equitable price. The latter is writing its history, in letters of blood, on the appalling cloud of debt that is sweeping with ruin and desolation over the farmers of this country. [Applause.] What is said of wheat may be said of all our property.

"When it is considered that we are giving two dollars worth of property now, in payment for one dollar in gold, you will realize that we are now paying 100 per cent premium on gold. [Applause.]

"And this applies not only to our foreign business, but to our home business.

"With silver remonetized, and a just and equitable standard of values, we can, if necessary, by act of Congress, reduce the number of grains in a gold dollar till it is of the same value as the silver dollar. [Applause.] We can legislate the premium out of gold. [Applause.] Who will say that this is not an effective remedy? I pause for a reply!"

COIN waited for a reply. No one answering him, he continued:

"Until an answer that will commend itself to an unbiased mind is given to this remedy, that guarantees a parity between the metals, write upon the character of every 'international bimetallist' the words 'gold monometallist.'"

Pausing for a moment, as if still waiting for his position to be attacked, he proceeded:

"Give the people back their favored primary money! Give us two arms with which to transact business! Silver the right arm and gold the left arm! Silver the money of the people, and gold the money of the rich.

"Stop this legalized robbery, that is transferring the property of the debtors to the possession of the creditors!

"Citizens! the integrity of the government has been violated. A Financial Trust has control of your money, and with it, is robbing you of your property. Vampires feed upon your commercial blood. The money in the banks is subject to the check of the money lenders. They expect you to quietly submit, and leave your fellow citizens at their mercy. Through the instrumentality of law they have committed a crime that overshadows all other crimes. And yet they appeal to law for their protection. If the starving working man commits the crime of trespass, they appeal to the law they have contaminated, for his punishment. Drive these money-changers from your temples.

Let them discover by your aspect, their masters - the people."

[Applause.]

"The United States commands the situation, and can dictate bimetallism to the world at the ratio she is inclined to fix.

"Our foreign ministers sailing out of the New York harbor past the statue of ''Liberty Enlightening the World" should go with instructions to educate the nations of the earth upon the American Financial Policy. We should negate the self-interested influence of England, and speak for industrial prosperity.

"We are now the ally of England in the most cruel and unjust persecution against the weak and defenceless people of the world that was ever waged by tyrants since the dawn of history. [Applause.]

"Our people are losing each year hundreds of millions of dollars; incalculable suffering exists throughout the land; we have begun the work of cutting each others throats; poor men crazed with hunger are daily shot down by the officers of the law; want, distress and anxiety pervades the entire Union.

"If we are to act let us act quickly.

"It has been truthfully said:

"'It is at once the result and security of oppression that its victim soon becomes incapable of resistance. Submission to its first encroachments is followed by the fatal lethargy that destroys every noble ambition, and converts the people into cowardly poltroons and fawning sycophants, who hug their chains and lick the hand that smites them!'

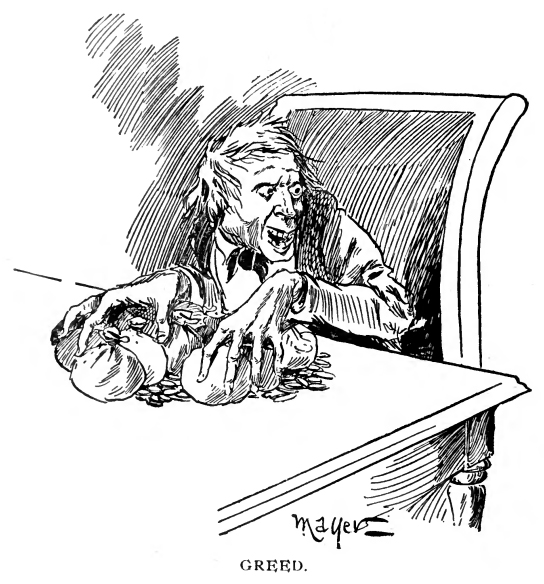

"Oppression now seeks to enslave this fair land. Its name is greed. Surrounded by the comforts of life, it is unconscious of the condition of others. Despotism, whether in Russia marching its helpless victims to an eternal night of sorrow, or in Ireland where its humiliating influences are ever before the human eye, or elsewhere; it is the same.

"It is already with us. It has come in the same form that it has come everywhere - by regarding the interests of property as paramount to the interests of humanity. That influence extends from the highest to the lowest. The deputy sheriff regards the $4 a day he gets as more important to him than the life or cause of the workmen he shoots down.

"The Pullman Palace Car Company recently reduced the already low wages of its employees 33⅓ per cent. Unable to make a living, they laid down their tools. A few days later the company declared a quarterly dividend of 2 per cent on watered capital of $30,000,000. This quarterly dividend was $600,000.

"Had this company sent for the committee of the workmen and said, 'We were about to declare our regular quarterly dividend of 2 per cent; it amounts to $600,000; we have concluded to make it 1½ per cent; this will give us $475,000 for three months, or one quarter's profits, and we are going to use the other $125,000 to put back the wages of the men. There would have been no strike. The men would have hailed it as generosity, and the hearts of 4,000 workmen would have been made glad.

"It was not done. It was not to be thought of. These stockholders living in comfort with all their wants provided for, think more of their property interests than they do of humanity, and will see men starve or reduced to the condition of serfs rather than concede an equitable distribution of the profits of their business.

"This has occurred here in the city of your homes; in the World's Fair city; a city supposed to be as patriotic as any we have; if this is human nature here, what do you expect from the men in England who hold our bonds, notes and mortgages payable in gold.

"We are forced to take independent action. To hesitate is cowardly! Shall we wait while the cry of the helpless is heard on every hand? Shall we wait while our institutions are crumbling?"

(Cries of "No no no!")

"This is a struggle for humanity. For our homes and firesides. For the purity and integrity of our government.

"That all the people of this country sufficiently intelligent to vote cannot understand that the reduction of our primary money to one half its former quantity reduces the value of property proportionately, is one of the inexplainable phenomena in human history.

"Those who do understand it should go among the people and awake them to the situation of peril, in which they are placed. Awake them as you would with startling cries at the coming of flood and fires.

"Arouse them as did Paul Revere as he rode through the streets shouting: 'The British are on our shores.'

"To let England dictate to us was not once the spirit of Americans.

"When Benjamin Franklin was minister to England he attended a banquet in London, at which, toasts were responded to by the Premier of England, and the ministers of France and the United States. The toast in each instance was the government represented by the official responding.

"The toast to England came first and was responded to by the Premier. He was eloquent in praise of his country, and at the close of his speech took up his wineglass and said, 'Now drink with me again to England, the Sun that gives light to the world.'

"As Mr. Franklin arose to respond to the toast - the United States - all eyes were upon him. The French minister had taken up the gage thrown down by the Premier of England and had responded fittingly as to the position of France among the nations of the earth. What would Mr. Franklin say? Would he properly acquit himself for the United States?

"At the close of an able response, suitable to such an occasion, Mr. Franklin placed his hand on his wineglass, and lifting it to a level with his eyes, said 'Now drink with me again to the United States, the Joshua that commanded the sun and moon to stand still, and they stood still.'

[Applause.]

"Had Mr. Franklin had the ears of all the people of the United States on that occasion, one universal acclaim would have resounded throughout this land.

"If we had an administration and Congress now, that would say to England 'Stand still' - one glad shout would be heard in this country from Sea to Sea and Lakes to Gulf, proclaiming the second independence of the United States." [Long continued applause.]

COIN had finished. The audience had risen to its feet, and the applause was tumultuous and continued. Those on the stage were shaking the little statesman's hands, and many others were crowding around the platform.

As the tumult subsided a fine-looking gentleman appeared on the platform with his hands raised to command attention. It was Mr. J. L. Caldwell, president of the First National Bank of Huntington, West Virginia. As soon as he had secured attention he said:

"I am the president of a national bank, and I want to first say to you people that all national bankers do not regard selfish personal interest, as paramount to love of country and the interests of the whole people.

"A few of us have stood out against this gold standard system, and are in favor of immediate free coinage, 16 to 1 or 15½ to 1, independent of England. [Applause.]

"I now propose three cheers for COIN."

They were given with a will. The hip! hip! hurrahs! were heard through the open windows for two squares away.

Thus ended the "school." Chicago has had its lesson on bimetallism.

How will this contest end?

No one can tell. In the struggle of might against right, the former has generally triumphed.

Will it win in the United States ?