Matrix Files

Where You Have Taken The Red Pill

Coin's Financial Course - Chapter II - THE SECOND DAY.

« Chapter 1 PDF File found here Chapter 3 »

CHAPTER II.

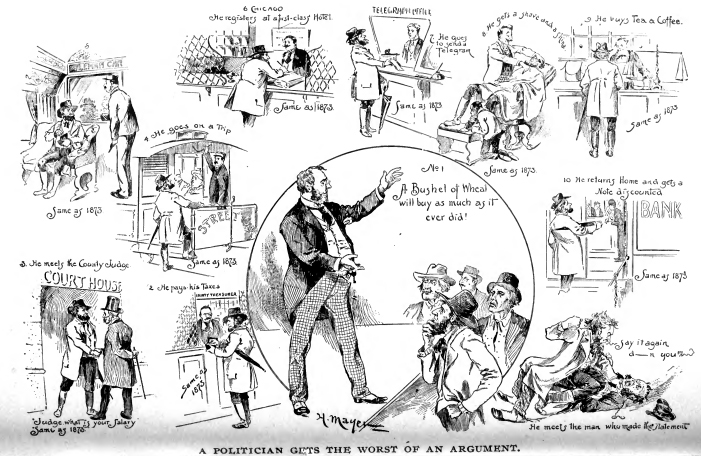

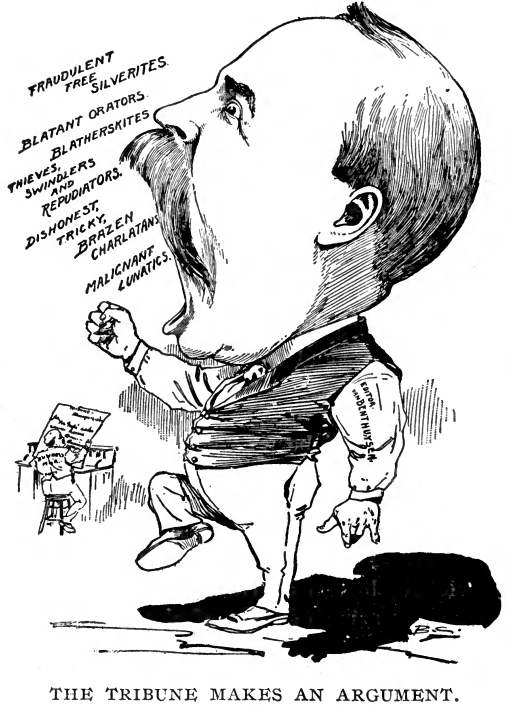

When the news went out in Chicago at the end of the first day, that COIN, the little financier, had answered satisfactorily all questions that had been asked him, the old gold men hooted at it, and said that no one but boys were there to confront him. The morning papers except The Times, and Record published a garbled account of what had actually taken place. The Tribune and Herald were editorially loaded with abuse. The editor-in chief of The Tribune was a Mr. Van Benthuysen. He had been told by the owners of that paper to write an argument in favor of the gold standard. In an editorial of thirty lines he called bimetallists "fraudulent free silverites," "blatant orators,” "blatherskites," "thieves," "swindlers," "repudiators," "dishonest, trickey, brazen charlatans," "malignant lunatics," repeating some of these choice epithets several times.

The next day one of the proprietors called his attention to this editorial and asked him why he didn't write an argument. His reply was: "Argument! That's the only argument there is!"

On the morning of the second day when COIN arrived at the Art Institute, he found the hall full of people, most of them middle-aged and old men. He was asked to throw the "school" open to persons of all ages. This was a move to put a quietus on the success of the lectures. Knotty questions would be hurled at him - perplexing queries and abstruse proposition.

They would harass him worry him, and tangle him, laugh at his dilemma and then say: "We told you so." This was the programme. COIN consented. All the seats were filled and many persons were standing. Perfect order prevailed as COIN began his lecture.

THE RATIO.

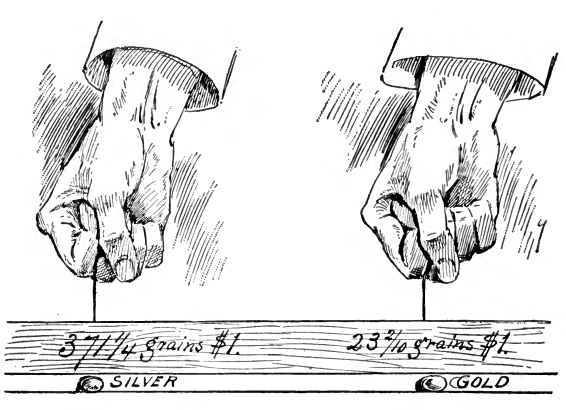

"The ratio between silver and gold," said COIN, "prior to 1873, in the United States was fixed at 16 to 1 and for the purposes of coining token silver dollars is still the ratio. That is, the silver in a silver dollar is just sixteen times as heavy as the gold in a gold dollar. Or to reverse it, the gold in a gold dollar is just 1/16 the weight of the silver in a silver dollar.

"Up to 1834, when the ratio was 15 to 1, the gold in a gold dollar was 1/15 the weight of the silver in a silver dollar. When the ratio was changed to 16 to 1, the quantity of gold in the gold dollar was lessened and made 1/16 the weight of the silver in a silver dollar.

"The quantity of silver in the silver dollar was not disturbed. It being the unit, was respected, and remained the same. The gold dollar was cut down from 24.7 grains pure gold to 23.2 grains of pure gold. So that now it is one-sixteenth the weight of the pure silver (371¼ grains) in the silver dollar. This is what ratio means."

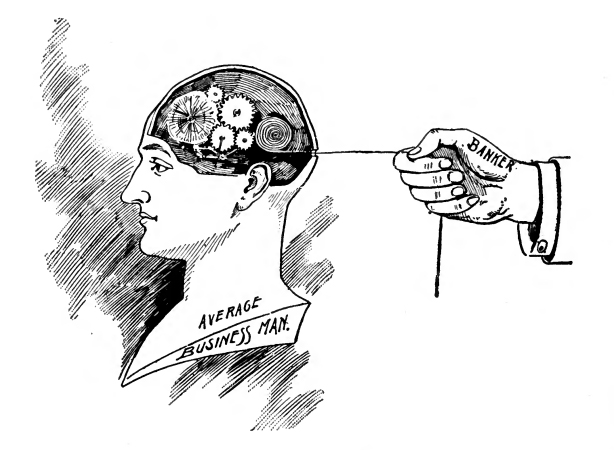

Mr. Lyman Gage, president of the First National Bank of Chicago, interrupted the little speaker. He had been watching for an opening, and he now thought he had it, where he could deliver a telling, and follow it up with a knock-out, blow. He rose to his feet. All eyes were on him. In Chicago Lyman Gage is at the "top of the heap." His word is law on the subject of finance. "How does he happen to be at the head of the largest bank west of the Alleghanies, if he does not know all about it?" This is the way the Chicago people reason when their thinkers are allowed to think.

As a rule they are a very busy set of men. On all such questions as a National finance policy their "thinkers" run automatically. Such men as Mr. Gage do their thinking for them. Cities do not breed statesmen. They breed the specialist. A specialist favors what will tend to promote his business though it may injure the business of others.

A statesman must be broad. He must have a comprehensive appreciation of the interests of all the people - especially the poorer classes. If he has been a rail splitter at one time, so much the better.

The men who produce the property of the world are the men whose happiness should be consulted. The men who handle this property after it is produced have little regard for the interests of the producers. Their selfishness and greed blind them. Their minds are running in a groove and they cannot see the rights of others.

Hence, Mr. Gage is a good banker - a specialist - but a poor statesman. Lincoln was a good statesman, but would have made a poor banker. The audience was mostly in sympathy with Mr. Gage, except those who had been won over to COIN the day before.

"I would like to ask a question," said Mr. Gage.

"Proceed," said COIN.

"How can you have, at any fixed ratio, the same commercial value on two separate metals, that are from time to time varying in the quantity of each produced?"

"This is the 'stock fallacy' of the gold monometallists," said COIN. "All commercial values are regulated by supply and demand. The commercial value of any commodity depends on supply and demand. If the demand for a particular commodity is continuously rising and the supply does not increase, the commercial value will continuously rise.

"When the mints of the world are thrown open and the governments say, 'We will take all the silver and gold that comes,' an unlimited demand is established. The supply is limited. Now with an unlimited demand and a limited supply, there is nothing to stop the commercial value of the two metals going up in the market, except the governments saying - 'Hold on - these metals are for money - we fix the value at which they circulate. This unlimited demand is for silver at $1 for 371¼ grains, and $1 for 23 2/10 grains of gold - we stamp these into dollars respectively in those quantities.'

"While an unlimited demand has been established, the point at which the supply can take advantage of that demand is fixed. And the demand pulls them both plumb up to that point. At 16 to 1 and 371¼ grains of silver as the unit, the commercial value of 371¼ grains of pure silver is a dollar, and an ounce of silver is worth $1.29 29/100, and 23 2/10grains of gold is worth a dollar, and an ounce of gold would be worth $20.68 64/100.

"I will illustrate it," and as COIN said this he quickly drew on the blackboard behind him the picture of two hands each drawing a cord through a hole in a beam of wood with blocks on the ends of the cords.

"Now," said COIN, as he leaned over and borrowed from Mr. Owen F. Aldis his cane, and pointing at the drawing on the blackboard, continued: "The hand drawing on the cord represents the power of unlimited demand, the beam represents the price at which the demand stops and the two little blocks on the ends of the cords, as close up against the beam as they can get, represent silver and gold.

The demand is represented by the two hands; if the one on the silver cord should relax its pull, the little wood block representing silver would drop down. The unlimited demand for one metal (silver) was taken away, the unlimited demand for the other metal (gold) was continued. The whole disturbance since then has come from the demand being taken away from silver."

Mr. Gage had remained standing for a time, then resumed his seat, and became interested.

COIN continuing, said: "England demonetized silver in 1816, but as Germany, France and the Latin Union, and the United States had their mints open to the free coinage of silver and gold, the demand thus created was sufficient to maintain the parity (equal value) of the two metals, and the action of England had no effect on the price of silver.

"No one in England would part with his silver for less than an equal value in gold, when he could cross the channel into France and get an even exchange so the price of silver as measured in gold was during all the years prior to 1873 substantially at par in England and the world over.

"The United States closed its mints to silver and made gold the sole measurement of values in February.

"Germany followed and passed the same law in July, 1873. The action of these two large nations caused a drop in the commercial value of silver as measured in gold of 2 per cent by the end of that year.

"France and the Latin Union closed their mints to the free coinage of silver in January, 1874, and by the end of that year silver as measured in gold had declined 4 per cent.

"Then came the gradual breaking down of the commercial price of silver as measured in the new standard - gold - and acts were passed tending to this end. Among them were the acts of 1876 stopping the coinage of the trade dollars by which we were supplying China and the Orient with coin, and the law in 1878 authorizing and sanctioning notes, bonds and mortgages, to be taken payable in gold only. This latter is a clause in the Bland-Allison act, a copy of which can be found in COIN'S HAND BOOK, or can be obtained from any of your congressmen. It discriminates against all our other forms of money and allows the creditor to dictate that his credits shall be payable in gold.

"These acts have been followed up by the declared policy of the government to redeem all other money, including silver, in gold.

"The same class of legislation was simultaneously in progress in Europe, so that by the summer of 1893 silver had declined 35 per cent. Then came the closing of the mints of India to silver and the decline increased to 50 percent.

THEIR COMMERCIAL VALUE COMPARED

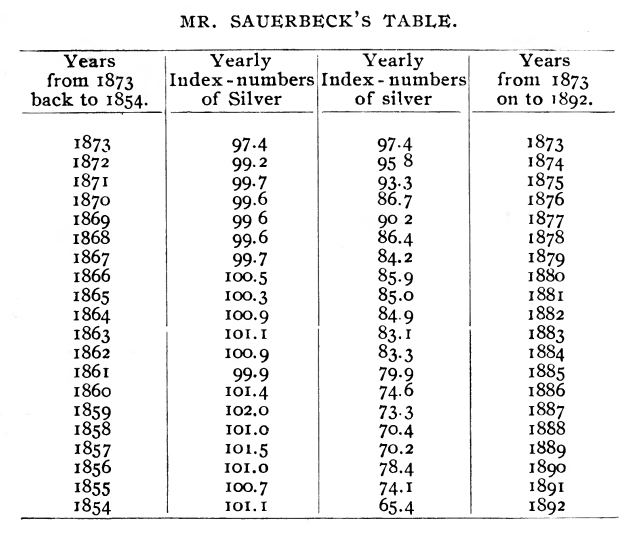

"Comparing the prices," continued COIN, "of the relative commercial values of the two metals for the whole world, Mr. Sauerbeck, an English statistician, has prepared a table showing the value of silver as measured in gold for 19 years before and 19 years subsequent to 1873. The table expresses it in index numbers. It is London quotations.

"I have these tables printed," said COIN, "and will cause them to be distributed among you."

Little boys then went through the school and gave every one a copy of the table. COIN waited till the tables were distributed and then, looking straight at Mr. Gage, he said:

"You will see from this table that during the 19 years prior to 1873, while free coinage was the law in the nations I have named, the commercial value of silver in the London market - in gold standard England - did not vary more than 2 per cent. - 8/10 of 1 per cent under was the least, and 2 per cent over was the greatest.

"The average for the 19 years shows a premium on silver over gold, which is explained by the disturbance created by the difference ratios in France and the United States.

"If the same ratio had existed in all these countries, then the only difference would have been the exchange difference, the cost of freight in the movement of bullion when unevenly distributed as between silver and gold when needed at different points.

"Nor did the varying points quantities of silver and gold in the world, during this period from 1854 to 1872, have the least effect on the relative commercial vaue of these two metals.

"Mr. Mulhall, the London Statistician, has compiled statistics showing the relative quantity of silver and gold in the world at different periods, and his figures are substantiated by the official reports of the governments of the world from which they were taken.

"He gives the relative quantity in 1848, 1880 and 1890, but does not give it at any other date between these periods. But taking the dates he does give, we find that in 1848 there were 31 tons of silver to 1 ton of gold in the world. In 1880, 18 tons of silver to 1 ton of gold. In 1890, 18 tons of silver to 1 ton of gold.

"Now as the relative supply cf silver to gold was decreasing from 1848 to 1880, then this decrease was in progress between 1854 and 1872, and yet during this period it had no effect on the relative value of the two metals.

"If Mr. Sauerbeck's table was extended back to 1848 or to 1792, the variation in it would be no greater than existed between 1854 to 1872.

"And yet we find that there were 31 tons of silver in 1848 to 1 ton of gold a large over-production of silver as compared with gold. Using the official figures given by Mr. Mulhall, and estimating from them, the proportion in 1872 was 19 tons of silver to 1 of gold. The production of silver had become materially less as compared with gold, and yet through all these years from 1848 to 1872, there was no difference in the commercial value of the two metals that would not be accounted for by the French ratio disturbance and the cost of exchanging the two metals.

"During the period between 1849 and 1854 the gold mines of California added largely to the world's stock of gold. So much so that men of Mr. Gage's views as to supply of the two metals varying, started a propaganda for the demonetization of gold.

"And yet with all that gold output, we find that it had no effect on the relative commercial values of the two metals. The reason why it could have had no effect was because the demand for either was unlimited. Both enjoyed the same advantage in that respect. The attempt that was then made to demonetize gold had not gone far, when to the surprise of those that were engaged in it, gold maintained its commercial value. They realized then by the practical workings of free coinage of the two metals, their error and abandoned the effort.

"Had specie payments been in operation in 1873, no doubt silver never would have been demonetized. Nearly every one would have been alive to the interest of our metallic money and it would have been daily asserting its own importance as in 1850-54.

"It was during a period of suspension of specie payments in England following the French war that parlament demonetized silver in 1816, in much the same manner that it was accomplished in this country.

A COMPARISON FOR 2OO YEARS.

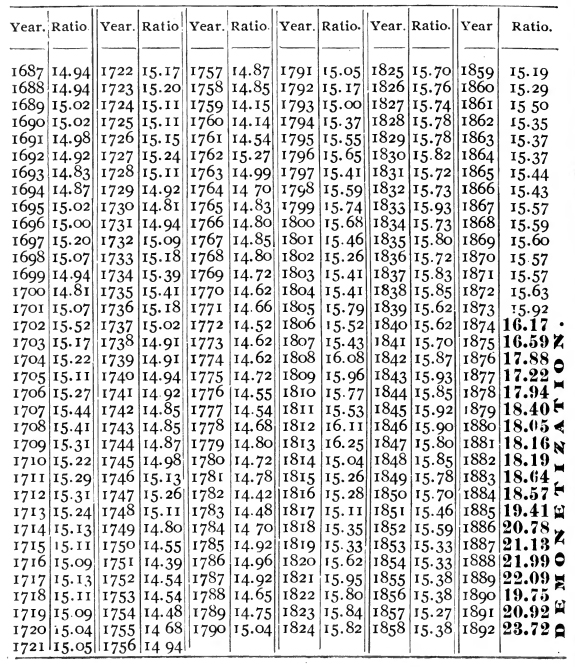

"To show you how perfectly the law of free coinage worked from time immemorial till 1873, in sustaining the commercial value of silver and gold at a parity, I am now going to distribute among you a copy of page 50 of the 'Statistical Abstract' for 1892, issued by the Treasury Department of the United States."

COIN waited until they were distributed, and every one in the room had one in his hand, including Mr. Gage.

(Page 50 from U. S. Statistical Abstract 1892.)

RATIO OF SILVER TO GOLD.

COMMERCIAL RATIO OF SILVER TO GOLD FOR EACH YEAR SINCE l687.

[NOTE. From 1687 to 1832 the ratios are taken from the tables of Dr. A. Soetbeer; from 1833 to 1878 from Pixley and Abell's tables; and from 1878 to 1892 from daily cablegrams from London to the Bureau of the Mint.]

"You will see from this table," continued COIN, "that from 1687 to 1873 the commercial ratio of the two metals was never lower than 1 to 14.14, and never higher than 1 to 16.25, a variation of only about two points.

"This difference is accounted for by the difference in ratios fixed by different governments, and the cost of exchange; ours being 15 to 1 prior to 1834.

"Run your eyes down these columns from 1687 to 1873 and see how smooth the commercial ratio appears.

"Now all stop, with your fingers on 1873! Up to this point through two centuries we see how the commercial value of silver and gold was kept at a parity notwithstanding the varying supplies of the two metals.

"Now run your fingers down from 1873 to 1892, and in that short period what a change, O! my countrymen.

"Instead of 15 to 16 pounds of silver being worth one pound of gold, we see it jumping rapidly, till in 1892 it took nearly 24 pounds of silver to equal in commercial value one pound of gold. And now it takes 32 pounds of silver to equal in the market one pound of gold.

"While in 200 years there was under free coinage a variation of only about 2 points, in 21 years, under demonetization there is a variation of 16 points, and during the latter period the proportion of silver to gold produced has been growing less.

"We here have a demonstration of how free coinage controls the commercial value of the two metals.

"So true and accurate was this effect of free coinage or unlimited demand for both metals in fixing their parity at the ratio established, they were virtually one metal, and a difference in production of either could not have, and did not have, the least influence.

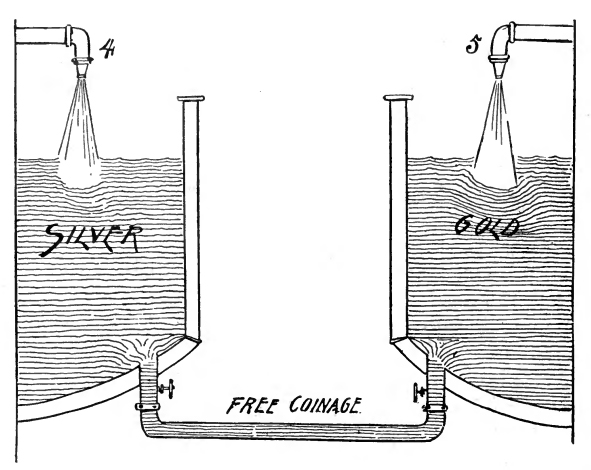

"I will illustrate it another way." In less than a minute COIN had drawn on the blackboard two reservoirs filled with water and connected with each other by a pipe.

"Now," said COIN, pointing with the cane at the reservoirs and their connecting pipe, "the water in one of these reservoirs represents silver and the other gold. The connecting pipe makes them virtually one metal and either answers the requirement of the government for money.

"So long as that connecting pipe remains, the water in the two reservoirs will remain even the same height. Do away with the connecting pipe and the feed pipes at 4 and 5 will soon destroy the equilibrium, as their quantities vary from time to time.

"The law of free coinage (the connecting pipe) maintains the parity of the two metals. When that was taken away from silver and left on gold a disturbance was natural.

"Prior to 1873, when the connecting pipe was working freely, the ratio in France was 15½ to 1, while in this country it was 16 to 1, and this difference in ratio was the only disturbing element, causing only slight fluctuations in the comparative value of the two metals, when measured in each other this depending on the direction in which the bullion was moving:

"But the moment the 'connecting pipe' was cut, the derangement in the values of the metals and of all property began.

And now," said COIN, "if I have not answered Mr. Gage's question, I want him to say why I have not."

Mr. Gage had been listening to with rapt attention. A pin could almost have been heard to drop at any moment. No sound was heard except the voice of the young speaker, whose pleasant style of address had a charm about it that did not wear away. There were many scholars and thoughtful business men in the audience, men of intelligence. Many of them owned large business blocks. Capitalists who had made Chicago what it is; such men as Leander McCormick, H. H. Kohlsaat, L. Z. Leiter, Phil. D. Armour, Potter Palmer and Samuel Allerton; merchant princes like Marshall Field, John V. Farwell and Franklin MacVeagh; lawyers of local and national reputation, such as Luther Laflin Mills, Judge Henry G. Miller, Judge Collins, Jno. S. Cooper, Edwin Walker and A. S. Trude.

There was a fascination in COIN'S manner of delivery that had caused every word he uttered to be heard and understood. They had listened critically, expecting to detect errors in his facts or reasoning. There were none. They were amazed. He was logical.

Real estate owners who had seen their rents going down, their houses becoming vacant, while their taxes were growing bigger; merchants who had been doing business on a falling market for twenty years, now felt as if they had each an interest in this money question.

MR. GAGE MAKES AN ADMISSION.

Mr. Gage arose and said: "What you have said about the commercial value of silver and gold being maintained at a parity under a fixed ratio, has been due to the enlarged use of these two metals, as money, under a free coinage law adopted by the principal nations of the world, International bimetallism would do what you say. But the United States alone could not maintain the parity of the two metals. Silver would be the cheaper, and gold would leave us. We would have no credit abroad, and a total derangement of our commerce would follow. And in this respect you have not satisfactorily answered my question."

"Then, Mr. Gage," said COIN, "we agree, do we, that the commercial value of silver and gold can be maintained at par on a fixed ratio at 15½ to 1 or 1 6 to 1, if their free coinage is provided for by the same nations that had such a law in 1873?"

"Yes," said Mr. Gage, "we agree thus far."

"Thanks," said COIN. "If all are as well satisfied thus far as Mr. Gage, we have gained a great deal. To understand these fundamental principles as far as we have gone, and as adapted and applied in the past, and as tested and proven a success, is essential to our further study of this subject.

"In arranging the programme for this school, I thought it best to leave the subject of independent free coinage by the United States to the last. I will not now change the order. When I answer that question it will be as simple and as satisfactory as any we have yet encountered.

"From the tone of the press in this city, it will be readily understood that we do not agree on the cause of the present depression in business, and how much of it is properly chargeable to the demonetization of silver. Let us first find out the cause of this calamitous condition of things and then we will speak of the remedy.

"We have seen that the closing of the mints, first of the United States, secondly Germany in 1873, followed by France and the Latin Union in 1874, depressed the price of silver as measured in gold 35 per cent. And the closing of the mints to silver in India, in 1893. further depressed its price to 50 per cent.

QUANTITY OF GOLD AND SILVER.

"Before demonetization both metals constituted the redemption money of the world; and as both metals existed in about the same quantities, it gave us twice as much money of redemption as gold alone will now furnish us. There is in the world now, according to the report of the director of our mint, $3,727,018,869 in gold, and $3,820,571,346 in silver.

"The dislocation of the parity of the two metals by the demonetization of silver, and the attempt to maintain our credit in gold, has reduced the redemption money of the world from $7,547,590,215 to $3,727,018,869, or a little less than one-half the original amount."

A REAL ESTATE MAN ASKS A QUESTION.

"I want to know," said Mr. George H. Rozet, a real estate dealer, here interrupting COIN, "why you say silver is demonetized, when it is in circulation every day and handled by us as money?"

"We have seen," replied COIN, "how the commercial value of the two metals were parted. By the same laws that produced this result, silver was made redeemable in gold, and ceased to be redemption money. Silver now circulates like paper money, both redeemable in gold. It is now subsidary coin or token money.

"Strictly speaking, nothing is money but redemption money. All other forms of so called money are money only in the sense that certified checks are money.

"In the sense in which you say silver is money, nickel and copper are money, but they form no part of our stock of redemption money. Gold now takes the place formerly occupied by both gold and silver, and is our only redemption money. Silver, as now treated, cuts no figure in our currency that could not be substituted by paper or other metals. What is meant by demonetization is, that silver has been destroyed as primary money.

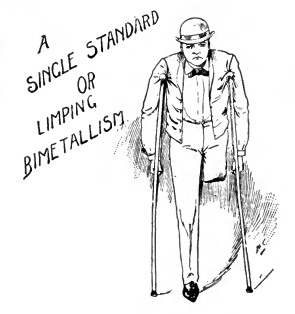

"We are now on a single gold standard, and have come to it through a period of limping bimetallism."

CHANGING RATIO.

Mr. Fred Miller, cashier of the Bank of Commerce, announced a desire to ask a question and proceeded to state it.

"It appears," said Mr. Miller, "that whenever the ratio has been changed, the number of grains of pure silver in the silver dollar has not been disturbed, while the quantity of gold in the gold coin has been changed; I want to know if there is any particular significance in this? Why change the gold and not the silver?"

"As silver was the unit" answered COIN, "more respect was paid to it than to the other metal. But there was another reason that would ordinarily have a controlling influence. I mean the cost of re-coining. There are about one hundred pieces of silver coin to one piece of gold coin. In coining ten million dollars in dimes, it requires the striking off of one hundred million coins. To coin one million dollars in quarters requires the striking off of four million coins. One million dollars in halves requires two million coins. One million silver dollars one million coins.

"While in making our gold money, comparatively few coins are required to be struck. One million dollars in ten dollar gold pieces requires only one hundred thousand pieces to be struck, and in twenties, 50,000. It would be much more expensive to recoin the silver than the gold. It would also be of great inconvenience to the government and the people to gather in all the silver coins, while it is of small inconvenience comparatively to collect in and recoin the gold.

"To re-coin the silver money is more expensive, and would take a much longer time than to re-coin the gold. But the greatest significance is in the fact that it was the money of the people. Its integrity and identity was respected by our forefathers.

"As our time to close the school for the day has arrived, we will now adjourn till 10 o'clock tomorrow morning." (Adjourned.)

Mr. Gage, and all those who, like him, had gone to hear COIN for the purpose of refuting his arguments, walked out of the room in a thoughtful manner. They had previously reached conclusions that the gold standard was the proper thing. They had only studied one side of the question. They had become firm in their opinions, and had worked up memorials to Congress against the free coinage of silver.

They had not based these opinions on the necessity of international bimetallism, but upon the theory that a gold standard is the best financial system for the United States to adopt.

Now, having met for the first time some one who knew the science of money, they were surprised. That it should come from the lips of a boy they were more surprised. Instead of scoffing at him, and confusing him, they had listened and been compelled to give assent to his plain and unanswerable views.

Their hope now laid in preventing him from showing that the demonetization of silver was the cause of low prices stagnation in business, and the deranged industrial condition of the country. That we have been compelled to adopt a financial system forced upon us by Europe.